Faststream Recruitment conducted an extensive, global survey and connected with thousands of Naval Architects and Marine Engineers to gain a unique insight into their views, thoughts, and feelings about the future of work. The pandemic continues to impact the world and we have uncovered the trends that have been created by it.

Download the Naval Architecture Employment Review 2021 pdf here.

This report covers the following topics:

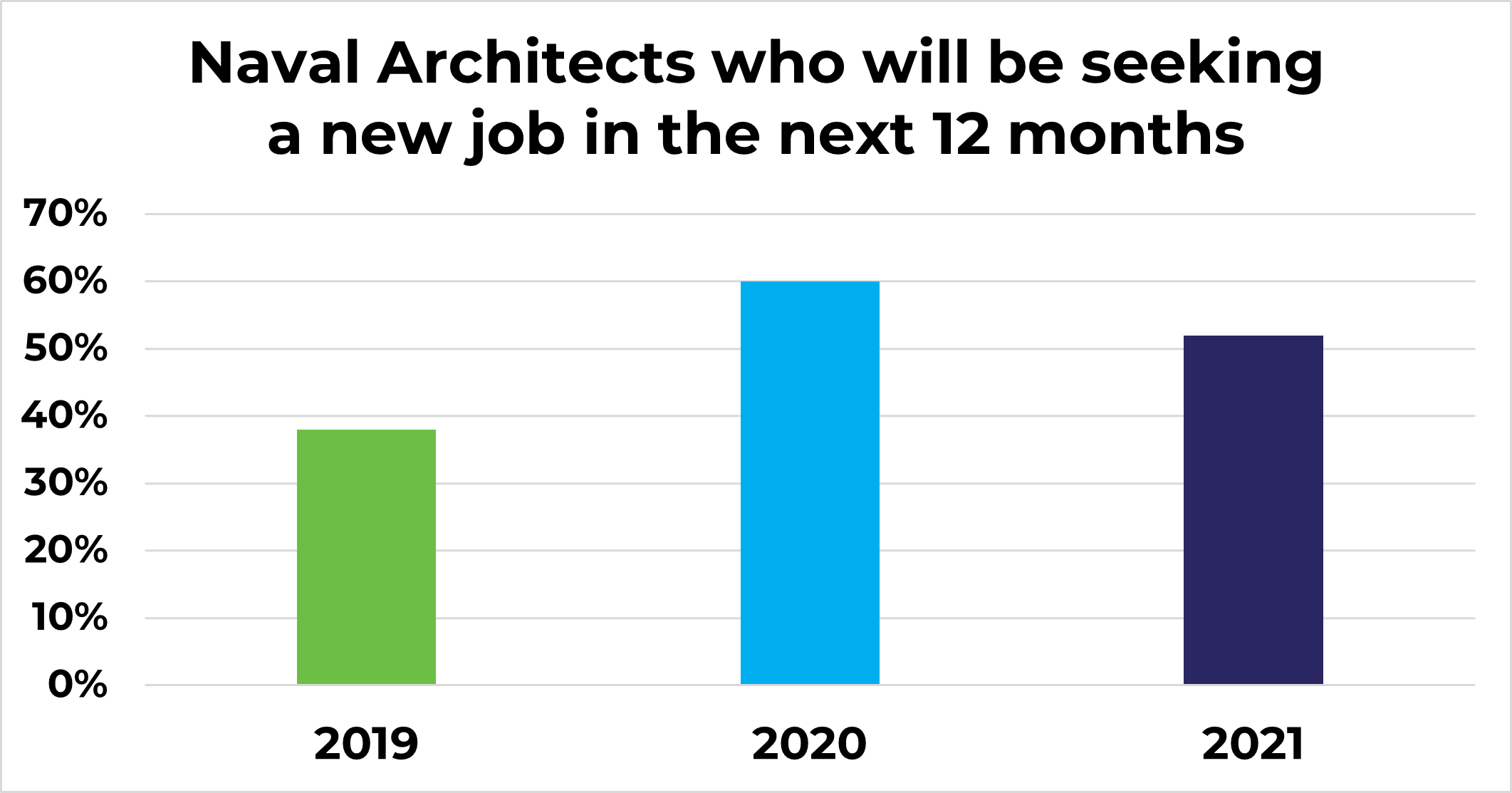

The tides have turned in the battle for employee retention

Over half of all Naval Architects told us they are seeking new jobs in the next 12 months. This leaves many business leaders in the predicament of potentially having to rehire half of their Naval Architecture workforce. The motivation to change jobs has shifted dramatically from 2020. Of those seeking new jobs in 2020, 63% cited that they were concerned about their job security. In 2021, a mere 4% were motivated to search for a new role because of this concern.

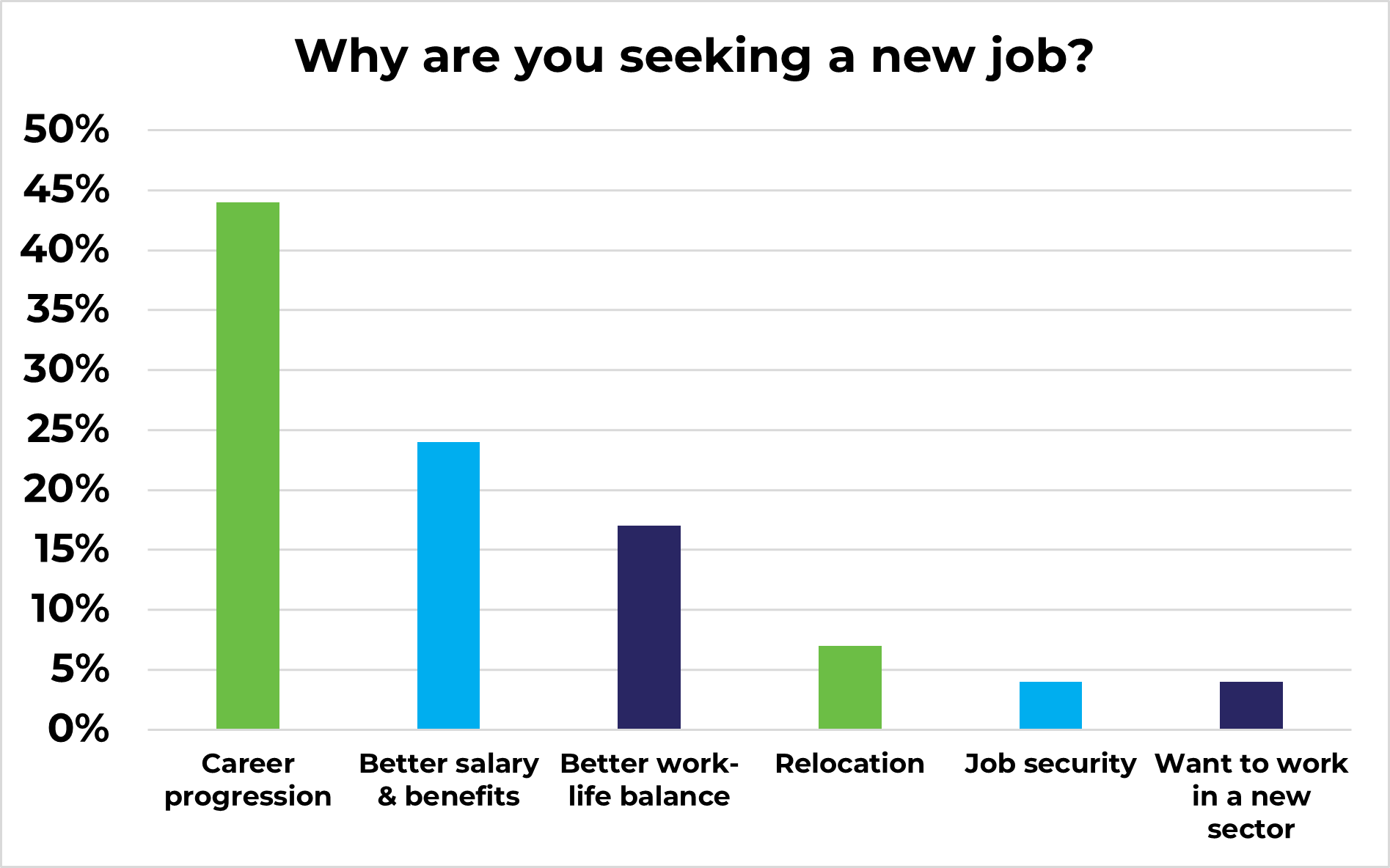

So why are Naval Architects seeking new jobs this year? The top answer from all global respondents was career progression (44%), followed by better salary and benefits (24%)and better work-life balance (17%). This was an encouraging change in motivation from the previous year. Job seekers wanted to improve their careers and achieve progression rather than carrying concerns that their jobs were at risk.

“Securing promotions and being offered new challenges is at the heart of why many individuals do what they do. Take away a structured career path with clear and specific roles, promotion criteria and benefits, and there will always be a danger of losing these ambitious people to businesses who can offer it.”

Of the 46% of respondents who were not looking to change their job in the next 12 months (2% of all respondents stated they were retiring), we wanted to find out what was making them stay with their employer. Work-life balance was voted at the top (28%), followed by a clear progression path with their current employer (23%) and the salary and benefits they were being offered (17%).

“Businesses that can offer their employees a good work-life balance are winning in the war for talent. Not only can it help attract the best and brightest new recruits, but it can also help to retain them. Allowing employees to work to live, rather than live to work, creates loyalty. Flexible working that embodies popular work practices such as remote working and flexi-time allows employees to fit their work schedules more effectively around their lives.”

Employees want shared values and for their employers to embrace diversity and inclusion

For the first time, we asked Naval Architects how important an employer’s policy on diversity and inclusion was to them. 82% agreed it was either important or very important. 63% of female Naval Architects rated it is as very important, whilst only 40% of males felt the same.

“I think that it is understandable that in a traditionally male-dominated field that females would be more passionate about seeing diversity and inclusion in a business. Many business leaders are now actively trying to attract a more diverse workforce, and this includes a better representation of females across the business.”

A Naval Architect in North America commented on this question and summed up the importance to many Naval Architects: “All factors being equal, diverse teams offer more varied viewpoints that will ultimately lead to better outcomes for employees and customers.”

We also asked how important it was that the respondent’s values match with a new employer’s. This was more important than diversity and inclusion across all respondents, and 94% agreed it was either very important or important to them. A Naval Architect working in Europe commented: “Company cultures can be toxic if you do not share the same values. It is of the utmost importance that everyone’s values align to ensure a better experience for all stakeholders.”

A re-prioritisation of employee benefits

The pandemic has created a re-prioritisation of employee benefits. Whilst traditionally many employees and job seekers were attracted to employers who offered better monetary benefits, we have seen that this year, it has switched to an increased prioritisation to lifestyle benefits. We asked, ‘What would the top three most important benefits be to you in your next job?’ Flexi-time and remote working were voted top across all respondents. 49% of both 25 to 34 year olds and 35 to 44 year olds rated flexi-time at the top. Remote working was the most popular benefit for those respondents working in both the UK and North America and flexi-time came out on top for those working in Europe.

Staff events and gym memberships, though quite commonly seen in benefit packages were rated at the bottom. This will have been impacted by the many who have had to switch to remote working and not been able to enjoy these benefits. Employees will now be seeking other value-adding benefits which we envisage is set to continue to change as new working styles mature over the next five years.

Our final question in this section asked respondents if work-life balance or salary was more important to them. 80% of respondents agreed that work-life balance was the most important.

“Ensuring that the benefits an employer offers include ways of improving work-life balance rather than just monetary benefits could be a real distinguisher in the market as an employer of choice.”

Future working styles

Remote working continues to be a hot topic in Naval Architecture and the future role of the office remains a popular subject in the wider maritime industry. The pandemic forced many teams to revert from traditional office-based working to a new remote working style. We found that before the pandemic 79% of Naval Architects were working in the office full-time, 14% were working in a hybrid style between the office and remote and just 7% were remote working full-time. When surveyed in June 2021 just 23% of Naval Architects were in the office full-time, 44% were remote working full-time and 33% were working in a hybrid style. Those working part remotely and part in the office averaged 2-3 days per week working in the office environment.

The pandemic has drastically changed the landscape of working styles but how do Naval Architects want to work in the future? 73% favoured the hybrid style. Only 15% wanted to work in the office full-time and 12% remotely full-time. It was the youngest (under 24 year olds) and the least experienced (0 – 2 years’ experience) who favoured the office environment full-time, whilst those in the age groups of 45-54 years old and 55-64 years old favoured the remote working model the most. Of those who preferred the hybrid model, 74% cited that 2-3 days would be the perfect amount of time in the office.

“It will not be an easy decision for any business leader to decide on the working style to offer their employees, whilst also trying to balance this out against local restrictions. Invariably whatever decisions are made may not benefit all employees or match with their preferred style.”

Leadership in a post-pandemic world

Arguably the world of work has changed forever, but has this, in turn, impacted what Naval Architects expect from their leaders? 72% believed that the pandemic had changed the way they expect to be led by their leaders in the future.

“I think it would be unwise for business leaders to think that employees hadn’t changed the way they expect to be led coming out of the pandemic. I believe employees will have more impact on what leaders do and how they do it. The empowerment created by remote working is making employees more confident to speak up.”

What do Naval Architects want from their leaders in the future and what do they see as the top attributes of future leaders? 31% rated effective communication at the top, followed by integrity (22%) and honesty (13%).

“I think these answers are creating a very clear picture of the behaviours expected from leaders going forward. Communication has risen as the top attribute due to the way many employees have had to confront adaptation and disruption propelled by new business initiatives as well as pandemic-related health concerns. Leaders who can be honest and pride themselves on their integrity are going to create employee engagement, trust and advocacy.”

Download the Naval Architecture Employment Review here.

Please contact Mark Charmanor Adam Graves to discuss the findings in more detail.